Revenue-based financing (RBF) has emerged as one of the most transformative funding solutions for modern businesses, offering a compelling alternative to traditional loans and equity financing. As the global revenue-based financing market experiences explosive growth, reaching an estimated $5.77 billion in 2024 and projected to grow to $9.81 billion in 2025, entrepreneurs and business owners are increasingly turning to this flexible funding model to fuel their growth ambitions.

What is Revenue-Based Financing?

Revenue-based financing is an innovative funding mechanism where businesses receive capital upfront in exchange for a percentage of their future revenue. Unlike traditional debt financing, RBF doesn’t require fixed monthly payments or personal guarantees. Instead, repayments fluctuate based on the company’s actual revenue performance, making it an ideal solution for businesses with seasonal variations or unpredictable cash flows.

In this arrangement, investors provide capital to businesses and receive a predetermined percentage of the company’s monthly or quarterly revenue until they’ve recovered their initial investment plus a return. This creates a win-win scenario where the success of the business directly correlates with the investor’s returns, aligning interests perfectly.

How Revenue-Based Financing Works

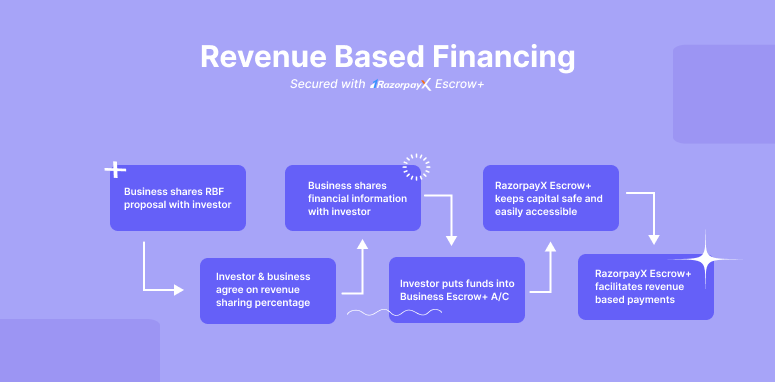

The revenue-based financing process typically follows a straightforward structure. First, businesses apply for funding by providing financial statements, revenue projections, and business metrics to potential RBF providers. The lender evaluates the company’s revenue history, growth trajectory, and market position to determine funding eligibility and terms.

Once approved, the business receives a lump sum of capital, usually ranging from $50,000 to several million dollars, depending on the company’s size and revenue potential. In return, the business agrees to pay back a fixed percentage of its monthly revenue, typically between 2% to 10%, until the total repayment amount is reached.

The repayment cap is predetermined and usually ranges from 1.2x to 3x the original funding amount, providing clarity on the total cost of capital. This structure ensures that during slow revenue months, payments decrease proportionally, while strong performance months result in higher payments, accelerating the repayment timeline.

Key Benefits of Revenue-Based Financing

Revenue-based financing offers numerous advantages that make it increasingly attractive to modern businesses. The most significant benefit is the preservation of equity ownership. Unlike venture capital or angel investment, RBF doesn’t require businesses to give up ownership stakes or board seats, allowing founders to maintain complete control over their company’s direction and decision-making processes.

The flexibility of repayment terms represents another major advantage. Traditional loans require fixed monthly payments regardless of business performance, which can strain cash flow during challenging periods. RBF payments adjust automatically with revenue fluctuations, providing breathing room during slower months while allowing businesses to pay more when they’re performing well.

Speed and accessibility also set revenue-based financing apart from conventional funding options. The approval process is typically faster than traditional bank loans, often taking weeks rather than months. Additionally, RBF providers focus primarily on revenue metrics and growth potential rather than personal credit scores or extensive collateral requirements, making it accessible to businesses that might struggle with traditional financing.

Industries Best Suited for Revenue-Based Financing

Revenue-based financing works exceptionally well for specific business models and industries. Software-as-a-Service (SaaS) companies are particularly well-suited for RBF due to their recurring revenue models and predictable cash flows. The subscription-based nature of SaaS businesses provides the steady revenue stream that RBF providers prefer.

E-commerce businesses also benefit significantly from revenue-based financing, especially those experiencing rapid growth or seasonal fluctuations. The ability to access capital quickly for inventory, marketing, or expansion while maintaining ownership makes RBF an attractive option for online retailers.

Digital marketing agencies, consulting firms, and other service-based businesses with recurring client relationships find RBF particularly valuable. These businesses often have predictable monthly recurring revenue but may need capital for expansion, hiring, or equipment upgrades without wanting to dilute equity.

Revenue-Based Financing vs Traditional Funding Options

Comparing revenue-based financing to traditional funding reveals distinct advantages and considerations. Unlike bank loans, RBF doesn’t require personal guarantees or extensive collateral, reducing personal risk for business owners. The qualification criteria focus on business performance metrics rather than personal credit history, making it accessible to newer businesses or those with limited credit history.

When compared to venture capital, RBF offers speed and simplicity. While VC funding can take months of due diligence and negotiation, RBF transactions typically close within 4-8 weeks. Additionally, businesses retain full ownership and control, avoiding the complex governance structures often associated with equity investments.

However, RBF may have higher effective costs than traditional loans, especially for businesses with strong credit profiles. The flexibility and speed of RBF come at a premium, making it essential for businesses to carefully evaluate whether the benefits justify the costs for their specific situation.

The Application and Approval Process

The revenue-based financing application process is designed to be streamlined and efficient. Businesses typically begin by submitting basic information about their company, including revenue history, growth projections, and key business metrics. Most RBF providers can make preliminary decisions within days of receiving this initial information.

Due diligence for RBF focuses heavily on revenue verification and business model analysis. Providers examine bank statements, accounting records, and customer metrics to understand revenue stability and growth potential. This process is generally less invasive than traditional loan underwriting, requiring fewer documents and personal guarantees.

Once approved, funding can be disbursed quickly, often within one to two weeks. The simplicity of the legal documentation, compared to complex equity investments, contributes to the speed of closing these transactions.

Market Growth and Future Outlook

The revenue-based financing market is experiencing unprecedented growth, with projections indicating massive expansion over the next decade. Market research suggests the global RBF market could reach between $67.88 billion and $178.3 billion by 2029-2033, representing compound annual growth rates of 39% to 66% depending on the source.

This explosive growth is driven by several factors, including the rise of SaaS and subscription-based business models, increased entrepreneurial activity, and growing dissatisfaction with traditional funding constraints. The COVID-19 pandemic also accelerated digital transformation, creating more businesses suitable for revenue-based financing models.

North America currently dominates the RBF market, but Asia-Pacific is emerging as the fastest-growing region, indicating global expansion of this funding model. As more success stories emerge and awareness increases, revenue-based financing is positioned to become a mainstream funding option for growth-oriented businesses.

Considerations and Potential Drawbacks

While revenue-based financing offers numerous benefits, businesses should carefully consider potential limitations. The cost of capital is typically higher than traditional bank loans, especially for businesses with strong credit profiles and collateral. The effective annual percentage rate can range from 10% to 40% or higher, depending on the terms and repayment timeline.

Revenue sharing also means that strong business performance results in higher absolute payments to the RBF provider. While this aligns interests, it can feel costly during particularly successful periods. Businesses should model various scenarios to understand the total cost under different growth trajectories.

Additionally, RBF may not be suitable for businesses with highly variable or unpredictable revenue streams. Providers prefer businesses with consistent, recurring revenue, which may exclude certain seasonal or project-based businesses from this funding option.

(FAQs) About Revenue-Based Financing

Q1 What types of businesses qualify for revenue-based financing?

Businesses with recurring or predictable revenue streams are ideal candidates for revenue-based financing. This includes SaaS companies, e-commerce businesses, subscription services, digital marketing agencies, and other service-based businesses with monthly recurring revenue. Generally, businesses need at least $10,000-$50,000 in monthly recurring revenue and a track record of growth to qualify for RBF.

Q2 How much does revenue-based financing cost compared to traditional loans?

Revenue-based financing typically costs more than traditional bank loans but less than equity financing in terms of ownership dilution. The effective cost ranges from 10% to 40% annually, depending on factors like business risk, industry, and growth potential. While more expensive than traditional debt, RBF offers flexibility and speed that often justify the premium for growing businesses.

Q3 How long does it take to get approved and receive funding through RBF?

The revenue-based financing process is significantly faster than traditional funding options. Initial approval decisions can be made within 24-48 hours of application submission. Complete due diligence and funding typically occur within 2-6 weeks, compared to 2-6 months for traditional bank loans or venture capital investments.

Q4 Can businesses use revenue-based financing multiple times?

Yes, many businesses successfully use revenue-based financing multiple times as they grow. Once a business has successfully repaid an initial RBF agreement, they often qualify for larger amounts in subsequent rounds. Some RBF providers offer ongoing credit facilities that allow businesses to draw additional capital as needed, similar to a line of credit.

Q5 What happens if my business revenue decreases after receiving RBF funding?

One of the key advantages of revenue-based financing is payment flexibility during revenue fluctuations. If your business revenue decreases, your monthly payments automatically adjust downward proportionally. This provides crucial breathing room during challenging periods, unlike fixed loan payments that remain constant regardless of business performance. However, extended periods of low revenue may trigger additional conversations with your RBF provider about business support or restructuring options.