Introduction to

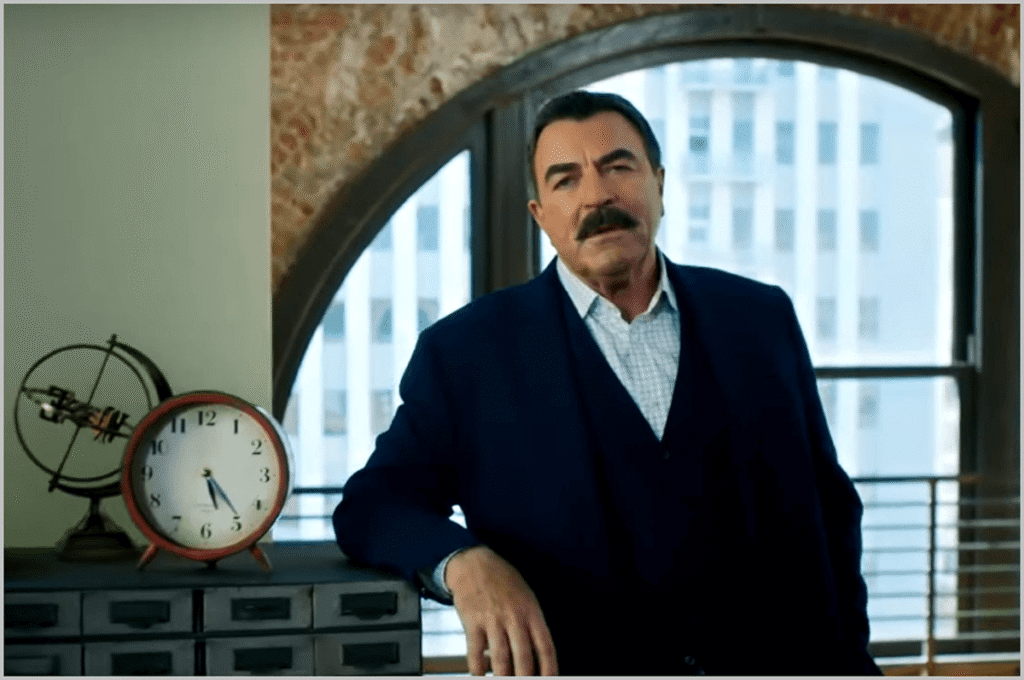

When older homeowners see a familiar face like Tom Selleck Reverse Mortgages AAG promoting a financial product, it naturally draws attention. Selleck, with his decades-long acting career and iconic mustache, has long been associated with trust and reliability. That trust was leveraged by American Advisors Group (AAG) to promote Tom Selleck Reverse Mortgages AAG — a tool designed to allow older homeowners to access their home equity without selling their home.

At first glance, reverse mortgages may seem like a perfect solution for retirement planning. They promise extra cash, flexibility, and the ability to age in place without financial worry. However, the reality is far more nuanced. Tom Selleck Reverse Mortgages AAG come with costs, obligations, and risks that many homeowners fail to understand. And the use of celebrity endorsements like Tom Selleck Reverse Mortgages AAG raises both interest and controversy.

In this article, we explore the connection between Tom Selleck Reverse Mortgages AAG. We will break down what these Tom Selleck Reverse Mortgages AAG are, why they are marketed the way they are, the controversies surrounding AAG, and whether a reverse mortgage is right for you.

Who is Tom Selleck — and Why Did He Partner with AAG?

Tom Selleck Reverse Mortgages AAG is one of the most recognizable actors of the past 50 years. Best known for roles in television series like Magnum, P.I., and Blue Bloods, he has cultivated a reputation for reliability, charm, and authenticity. These traits made him an attractive spokesperson for a financial company targeting older Americans.

In 2016, AAG chose Selleck as the face of its reverse mortgage campaign. The company wanted someone who could appeal to seniors while instilling confidence in a product often misunderstood or mistrusted. Selleck was seen as the perfect fit — a figure who could make complex financial decisions appear approachable and safe.

Selleck himself has said that he was initially skeptical about Tom Selleck Reverse Mortgages AAG. Like many, he assumed they were complicated, potentially predatory, or carried hidden risks. After reviewing the process and understanding the product’s potential for homeowners with limited income, he agreed to endorse AAG’s message. For him, the appeal was helping seniors access funds they might need for healthcare, home maintenance, or other retirement needs without selling their homes.

Through Selleck, AAG sought to humanize the financial product, presenting it as trustworthy and secure. However, his involvement also brought scrutiny because celebrity endorsements can create the perception of safety even when risks exist.

How AAG and Selleck Market Reverse Mortgages

AAG’s marketing strategy, with Tom Selleck Reverse Mortgages AAG front and center, is carefully designed to address common misconceptions and simplify the concept of Tom Selleck Reverse Mortgages AAG. Their advertising emphasizes three main ideas:

1. Home Equity as a Source of Retirement Income

Many seniors rely on three primary sources for retirement: Social Security, pensions, and savings. AAG promotes Tom Selleck Reverse Mortgages AAG as a “fourth leg” of retirement planning, allowing homeowners to tap into their home equity to supplement income.

The ads often feature simple analogies, such as comparing retirement planning to a stool: without home equity, it’s a three-legged stool that may wobble; with equity, it becomes a four-legged stool that’s stronger and more stable. This framing positions Tom Selleck Reverse Mortgages AAG as a practical and logical addition to financial planning.

2. Accessing Tax-Free Cash Without Selling

One of the key selling points is that homeowners can access tax-free cash without having to sell their homes. The money can be received as a lump sum, monthly payments, or a line of credit. For seniors who own their home outright but have limited liquid assets, this flexibility can provide critical financial support for everyday living expenses, medical bills, or home repairs.

Selleck’s messaging emphasizes that this is not a traditional loan with monthly repayments. Homeowners maintain ownership and can remain in their homes, making the product more appealing and less intimidating than conventional loans.

3. Reassurance and Emotional Appeal

Perhaps the most significant part of the marketing is the reassurance that reverse mortgages are not predatory. Ads often stress that banks are not looking to “take your home,” and that Tom Selleck Reverse Mortgages AAG are simply a financial tool designed to empower seniors.

Using Tom Selleck Reverse Mortgages AAG as the spokesperson amplifies this effect. Seniors are more likely to trust someone familiar and respected. The ads convey comfort and safety, creating an emotional appeal that sometimes overshadows the technical details and risks.

The Reality: Risks and Criticisms

Despite the polished marketing, Tom Selleck Reverse Mortgages AAG are not risk-free. Over the years, AAG has faced criticism and regulatory scrutiny for misleading advertising, inflated home-value estimates, and aggressive sales tactics.

Regulatory Scrutiny

AAG has faced enforcement action from federal agencies due to deceptive practices. Reports indicate that some homeowners were provided inflated estimates of their home value, leading them to believe they would receive more funds than was realistic. Misleading statements about the reliability of these estimates were also cited as a concern.

While these issues were addressed through settlements, they highlight the importance of caution. Regulatory action indicates that some aspects of the marketing, despite Selleck’s endorsement, may have misled consumers.

Real Consequences for Homeowners

Tom Selleck Reverse Mortgages AAG may lead to unintended consequences. Homeowners are still responsible for property taxes, insurance, and home maintenance. Failure to meet these obligations can result in foreclosure. Additionally, because the loan becomes due upon moving out or passing away, heirs may face challenges in repaying the loan, potentially resulting in the loss of the family home.

Many seniors may underestimate the impact of rising interest, compounding fees, and the long-term accrual of debt. While the marketing emphasizes simplicity and security, the reality requires careful planning and understanding.

Ethical Considerations

Using a celebrity to market complex financial products raises ethical questions. The emotional appeal and trust associated with a familiar figure can overshadow the risks, leading seniors to make decisions without fully evaluating the potential downsides. Critics argue that this approach can be manipulative, particularly when targeting financially vulnerable populations.

When a Reverse Mortgage Might Make Sense

Despite the risks, Tom Selleck Reverse Mortgages AAG can be appropriate in certain circumstances:

- Fixed Income with Limited Savings: Seniors who own their home but have minimal cash or pension income may benefit from the additional funds.

- Long-Term Home Residency: If a homeowner plans to stay in their home for many years, the loan can provide a steady source of funds.

- No Heirs or Inheritance Concerns: Those who do not intend to leave the home to heirs may find Tom Selleck Reverse Mortgages AAG a viable way to supplement retirement income.

- Urgent Financial Needs: Reverse mortgages may serve as a last-resort option when other financial solutions are unavailable.

When a Reverse Mortgage May Be a Bad Idea

- Expecting to Leave the Home to Heirs: The loan must be repaid when the homeowner dies or moves out, which can reduce or eliminate inheritance.

- Inability to Meet Obligations: Property taxes, insurance, and maintenance must be maintained; failure can trigger foreclosure.

- Inflated Home Value Expectations: Misleading estimates can result in lower-than-expected funds.

- Alternative Options Available: Downsizing, selling, or refinancing may offer better financial outcomes in many situations.

Questions Every Prospective Borrower Should Ask

- Do I really need this cash, or are there alternatives?

- Can I reliably meet property tax, insurance, and maintenance obligations?

- What are the true costs, including fees and interest accrual?

- What happens to my home after I move out or pass away?

- Have I consulted an independent financial advisor?

- Am I prepared for the long-term consequences of this decision?

The Power and Controversy of Celebrity Endorsements

Using Tom Selleck Reverse Mortgages AAG marketing demonstrates the power of celebrity endorsements. Seniors tend to trust familiar public figures, which can make complex financial products seem more approachable and safe.

However, this also raises ethical concerns. Emotional appeal can overshadow important technical details. Marketing that emphasizes comfort and security may unintentionally downplay the risks, leaving some seniors unprepared for potential challenges.

Conclusion

Tom Selleck Reverse Mortgages AAG partnership with AAG highlights the intersection of trust, marketing, and financial products. Tom Selleck Reverse Mortgages AAG can provide real benefits for some seniors, but they are not universally appropriate and carry significant risks.

Homeowners considering a reverse mortgage should carefully evaluate their financial situation, obligations, and long-term goals. They should not rely solely on celebrity endorsements or emotionally appealing advertising. Understanding the trade-offs, seeking independent advice, and planning ahead are essential steps to making an informed decision.

Ultimately, Tom Selleck Reverse Mortgages AAG should be approached with caution, awareness, and respect for the long-term implications on both personal finances and family inheritance.